Single Euro Payments Area

|

Single Euro Payments Area |

|

|---|---|

|

|

| Official languages | |

| Member states |

34 states

|

| Area | |

|

• Total

|

4,854,382 km2 (1,874,287 sq mi) |

| Population | |

|

• 2011 census

|

516,881,997 |

|

• Density

|

106.5/km2 (275.8/sq mi) |

| GDP (PPP) | estimate |

|

• Total

|

$11,465 billion (2012) |

|

• Per capita

|

$34,583 (2012) |

| Time zone | UTC, CET, EET (UTC±0 to +2) |

|

• Summer (DST)

|

WEST, CEST, EEST (UTC+1 to +3) |

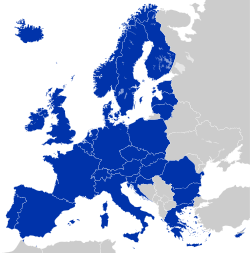

The Single Euro Payments Area (SEPA) is a payment-integration initiative of the European Union for simplification of bank transfers denominated in euro. As of July 2015[update], SEPA consists of the 28 member states of the European Union, the four member states of the European Free Trade Association (Iceland, Liechtenstein, Norway and Switzerland), Monaco and San Marino.

The project's aim is to improve the efficiency of cross-border payments and turn the fragmented national markets for euro payments into a single domestic one. SEPA will enable customers to make cashless euro payments to anyone located anywhere in the area, using a single bank account and a single set of payment instruments. People who have a bank account in a eurozone country, will be able to use it to receive salaries and make payments all over the eurozone, for example when they take a job in a new country.

The project includes the development of common financial instruments, standards, procedures, and infrastructure to enable economies of scale. This should, in turn, reduce the overall cost to the European economy of moving capital around the region (estimated as two to three percent of total GDP).

There are two milestones in the establishment of SEPA:

For direct debits, the first milestone was missed due to a delay in the implementation of enabling legislation (the Payment Services Directive or PSD) in the European Parliament. Direct debits became available in November 2009, which put time pressure on the second milestone.

The European Commission has established the legal foundation through the PSD. The commercial and technical frameworks for payment instruments were developed by the European Payments Council (EPC), made up of European banks. The EPC is committed to delivering three pan-European payment instruments:

...

Wikipedia