Myron S. Scholes

| Myron Scholes | |

|---|---|

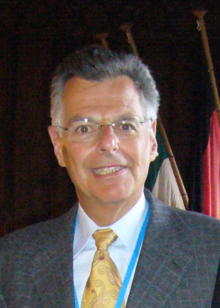

Scholes in 2008

|

|

| Born |

Myron Samuel Scholes July 1, 1941 Timmins, Ontario, Canada |

| Nationality | Canada, United States |

| Field | Financial economics |

| School or tradition |

Chicago school of economics |

| Alma mater | University of Chicago, McMaster University |

| Doctoral advisor |

Eugene Fama Merton Miller |

| Influences | George Stigler, Milton Friedman |

| Contributions | Black–Scholes model |

| Awards | Nobel Memorial Prize in Economics (1997) |

| Information at IDEAS / RePEc | |

Myron Samuel Scholes (/ʃoʊlz/; born July 1, 1941) is a Canadian-American financial economist. Myron Scholes is the Frank E. Buck Professor of Finance, Emeritus, at the Stanford Graduate School of Business, Nobel Laureate in Economic Sciences, and co-originator of the Black-Scholes options pricing model. Scholes is currently the Chairman of the Board of Economic Advisers of Stamos Capital Partners. Previously he served as the Chairman of Platinum Grove Asset Management and on the Dimensional Fund Advisors Board of Directors, American Century Mutual Fund Board of Directors and the Cutwater Advisory Board. He was a principal and Limited Partner at Long-Term Capital Management, L.P. and a Managing Director at Salomon Brothers. Other positions Scholes held include the Edward Eagle Brown Professor of Finance at the University of Chicago, Senior Research Fellow at the Hoover Institution, Director of the Center for Research in Security Prices, and Professor of Finance at MIT’s Sloan School of Management. Scholes earned his PhD at the University of Chicago.

In 1997 he was awarded the Nobel Memorial Prize in Economic Sciences for a method to determine the value of derivatives. The model provides a conceptual framework for valuing options, such as calls or puts, and is referred to as the Black–Scholes model.

Myron Scholes was born to a Jewish family on July 1, 1941 in Timmins, Ontario, where his family had moved during the Great Depression. In 1951 the family moved to Hamilton, Ontario. Scholes was a good student although fighting with impaired vision starting with his teens until finally getting an operation when he was twenty-six. Through his family, he became interested in economics early, as he helped with his uncles' businesses and his parents helped him open an account for investing in the while he was in high school.

...

Wikipedia