BRICS Development Bank

|

|

|

|

| Abbreviation | NDB, or NDB BRICS |

|---|---|

| Formation | July 2014 (Treaty signed) July 2015 (Treaty in force) |

| Type | International Financial Institution |

| Legal status | Treaty |

| Headquarters | Shanghai, China |

|

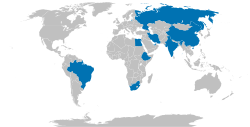

Membership

|

|

|

Official language

|

English |

|

President

|

K.V. Kamath |

| Website | www |

The New Development Bank (NDB), formerly referred to as the BRICS Development Bank, is a multilateral development bank established by the BRICS states (Brazil, Russia, India, China and South Africa). According to the Agreement on the NDB, "the Bank shall support public or private projects through loans, guarantees, equity participation and other financial instruments." Moreover, the NDB "shall cooperate with international organizations and other financial entities, and provide technical assistance for projects to be supported by the Bank."

The initial authorized capital of the bank is $100 bln divided into 1 mln shares having a par value of $100,000 each. The initial subscribed capital of the NDB is $50 bln divided into paid-in shares ($10 bln) and callable shares ($40 bln). The initial subscribed capital of the bank was equally distributed among the founding members. The Agreement on the NDB specifies that the voting power of each member will be equal to the number of its subscribed shares in the capital stock of the bank.

The bank is headquartered in Shanghai, China. The first regional office of the NDB will be opened in Johannesburg, South Africa.

The idea for setting up the bank was proposed by India at the 4th BRICS summit in 2012 held in Delhi. The creation of a new development bank was the main theme of the meeting. BRICS leaders agreed to set up a Development bank at the 5th BRICS summit held in Durban, South Africa on 27 March 2013. According to Devex, the name of the bank is believed to have been proposed by Indian Prime Minister Narendra Modi.

...

Wikipedia