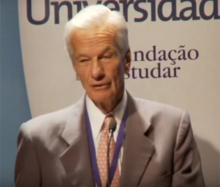

Jorge Paulo Lemann

| Jorge Paulo Lemann | |

|---|---|

|

|

| Born |

August 26, 1939 (age 77) Rio de Janeiro, Brazil |

| Residence | Zurich, Switzerland |

| Citizenship | Brazil, Switzerland |

| Education | Harvard University |

| Net worth | US$30 billion (February 2017) |

| Spouse(s) | Married |

| Children | 6 |

Jorge Paulo Lemann (born August 26, 1939) is a Brazilian-Swiss investor. He is ranked as the 26th richest person in the world by Forbes, with an estimated net worth of US$32.7 billion as of September 2016[update] He is the richest person in Brazil. As of 2015[update], Forbes Brazil listed Lemann as the top entry for the Richest Brazilians list.

In 1939, Lemann was born in Rio de Janeiro to Paul Lemann, a Swiss immigrant, who founded the dairy manufacturer, Leco, and Anna Yvette Truebner, a Brazilian of Swiss origin. Lemann attended the American School of Rio de Janeiro.

His father died in a bus accident in 1953, when Lemann was 14. In 1961, he received a bachelor's degree in economics from Harvard University. He won the Brazilian national tennis championship five times. He played for both the Swiss and Brazil Davis Cup teams, and played at Wimbledon.

Lemann married twice and has a total of six children. He usually spends his time between São Paulo, Rapperswil-Jona on Lake Zurich, where his family lives, and St. Louis. His first wife was Maria de Santiago Dantas Quental, a psychoanalyst who died in April 2005 aged 60. His second wife is Susanna Lemann, who has given birth to three of his children.

From 1961 to 1962, he worked as a trainee at Credit Suisse in Geneva. In 1966, the first company in which Lemann had equity interest, a lending company called Invesco, went bankrupt. Lemann had a 2% equity stake. In 1971, Lemann, Carlos Alberto Sicupira and Marcel Herrmann Telles founded the Brazilian investment banking firm Banco Garantia. Undaunted by a market crash that came only weeks later, Lemann was eventually able to build Garantia into one of the country's most prestigious and innovative investment banks, described in Forbes as "a Brazilian version of Goldman Sachs." All three now help to control AB Inbev as members of its board of directors.

...

Wikipedia