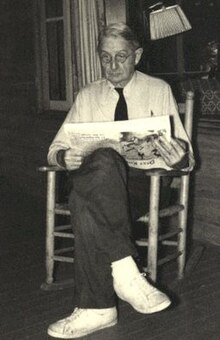

J. Maurice Clark

| John Maurice Clark | |

|---|---|

John Maurice Clark

|

|

| Born | November 30, 1884 Northampton, Massachusetts, U.S. |

| Died | June 27, 1963 Westport, Connecticut, U.S. |

| Nationality | American |

| Field | Political economics |

| School or tradition |

Institutional economics |

| Influences | Thorstein Veblen |

John Maurice Clark (1884–1963) was an American economist whose work combined the rigor of traditional economic analysis with an "institutionalist" attitude. Clark was a pioneer in developing the notion of workable competition and the theoretical basis of modern Keynesian economics, including the concept of the economic multiplier.

John Maurice Clark was born November 30, 1884, in Northampton, Massachusetts. He studied at Amherst College, graduating in 1905, and received his Ph.D. from Columbia University in 1910.

J.M. Clark was the son of economist John Bates Clark (1847-1938) and shared his father's concern with ethical and policy issues, in keeping with much intellectual thought during the progressive era. Both father and son worked would work jointly on rewriting and expanding John Bates Clark's 1912 book The Control of Trusts, with the new edition seeing publication in 1914. Work upon this theme would be continued by J.M. Clark in his Social Control of Business (1926, revised in 1939).

Clark was an Instructor at Colorado College from 1908 to 1910 and at Amherst College from 1910 until 1915, when he left to join the faculty of political economy at the University of Chicago. He accepted a professorship at Columbia in 1923, assuming the post previously held there by his father. He would remain at Columbia for the remaining three decades of his academic life, finally retiring in 1957.

Throughout his career Clark was concerned with the dynamics of a market economy.

In his early work Studies in the Economics of Overhead Costs (1923), Clark developed his theory of the acceleration principle, that investment demand can fluctuate widely when consumer demand fluctuates. In this he anticipated key Keynesian theories of investment and business cycles. Clark also examined the relationship between firm size and production cost, demonstrating the way firms with high fixed costs could dramatically reduce average cost of production by expanding output, thus explaining the price leverage wielded by giant firms in capital-intensive industries. The work illustrated the critical importance of accurate cost information for those seeking the effective regulation of monopolistic or oligopolistic firms.

...

Wikipedia