Inside Job (2010 film)

| Inside Job | |

|---|---|

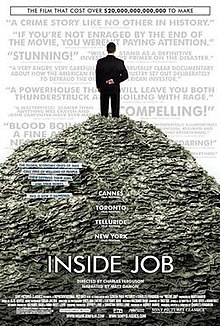

Theatrical release poster

|

|

| Directed by | Charles Ferguson |

| Produced by |

Audrey Marrs Charles Ferguson |

| Narrated by | Matt Damon |

| Music by | Alex Heffes |

| Cinematography | Svetlana Cvetko Kalyanee Mam |

| Edited by | Chad Beck Adam Bolt |

| Distributed by | Sony Pictures Classics |

|

Release date

|

|

|

Running time

|

108 minutes |

| Country | United States |

| Language | English |

| Budget | $2 million |

| Box office | $7,871,522 |

Inside Job is a 2010 documentary film, directed by Charles H. Ferguson, about the late-2000s financial crisis. Ferguson says the film is about "the systemic corruption of the United States by the financial services industry and the consequences of that systemic corruption". In five parts, the film explores how changes in the policy environment and banking practices helped create the financial crisis.

Inside Job was acclaimed by film critics, who praised its pacing, research, and exposition of complex material. The film was screened at the 2010 Cannes Film Festival in May and won the 2010 Academy Award for Best Documentary Feature.

Ferguson began doing research for the film in 2008.

The documentary is split into five parts. It begins by examining how Iceland was highly deregulated in 2000 and the privatization of its banks. When Lehman Brothers went bankrupt and AIG collapsed, Iceland and the rest of the world went into a global recession.

The American financial industry was regulated from 1940 to 1980, followed by a long period of deregulation. At the end of the 1980s, a savings and loan crisis cost taxpayers about $124 billion. In the late 1990s, the financial sector had consolidated into a few giant firms. In March 2000, the Internet Stock Bubble burst because investment banks promoted Internet companies that they knew would fail, resulting in $5 trillion in investor losses. In the 1990s, derivatives became popular in the industry and added instability. Efforts to regulate derivatives were thwarted by the Commodity Futures Modernization Act of 2000, backed by several key officials. In the 2000s, the industry was dominated by five investment banks (Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch, and Bear Stearns), two financial conglomerates (Citigroup, JPMorgan Chase), three securitized insurance companies (AIG, MBIA, AMBAC) and the three rating agencies (Moody’s, Standard & Poor's, Fitch). Investment banks bundled mortgages with other loans and debts into collateralized debt obligations (CDOs), which they sold to investors. Rating agencies gave many CDOs AAA ratings. Subprime loans led to predatory lending. Many home owners were given loans they could never repay.

...

Wikipedia