BUX

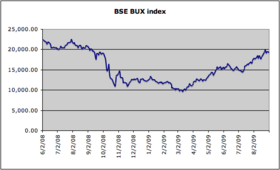

The performance of the BUX during the 2008 crisis

|

|

| Foundation | January 2, 1991 |

|---|---|

| Operator | |

| Constituents | up to 25 |

| Type | Large-cap |

| Weighting method | Free-float capitalization-weighted |

| Related indices |

CETOP20 BUMIX |

| Website | BUX homepage |

BUX is a consisting of the 25 major Hungarian companies trading on the . Prices are taken from the electronic Xetra trading system. According to the operator , the BUX measures the performance of the Equities Prime Market’s 25 largest Hungarian companies in terms of order book volume and market capitalization. It is the equivalent of the Dow Jones Industrial Average and DAX, the index shows the average price changing of the shares with the biggest market value and turnover in the equity section. Hereby this is the most important index number of the exchange trends.

BSE was one of the first in the world who started to use free-float capitalisation weightings instead of the traditional market capitalisation weightings in October 1999. The base date for the BUX is 2 January 1991 and it was started from a base value of 1,000. It is calculated in real time based on the actual market prices of a basket of shares. The BUX index is also a tradeable index. Its futures and option products are available in BSE’s derivatives section.

Ticker codes: Reuters: BUX, Bloomberg: BUX.

Beginning on October 14, 2015, after the close, the BUX consists of the following 14 major Hungarian companies:

The current components and weightings of the index: BUX Composition

...

Wikipedia